Most visitors to our office comment on the various canvases, sculptures and other art pieces which we have adorning our walls, floors and cabinets. In our case it’s to give support to local artists but I often get asked how much the various items are worth – to which I usually reply “I really don’t have a clue”.

But is art any good as an investment – and if you were wanting to diversify into art, how would you go about this?

Absolute Beginners

Art collecting and investment is no longer perceived as being limited only to the wealthy elite. If you have an interest in art, then you can diversify your assets and even find something nice to hang on the wall. At the very least, your investment will look a lot more interesting than a share certificate and may even give you something to take your mind off tumbling equity markets – which incidentally art is usually completely uncorrelated to.

When you invest in a piece of art, you're buying it with the expectation that demand for that piece or similar pieces will increase faster than the supply. If that happens, then the value of the piece will increase, and you may be able to sell it for a profit.

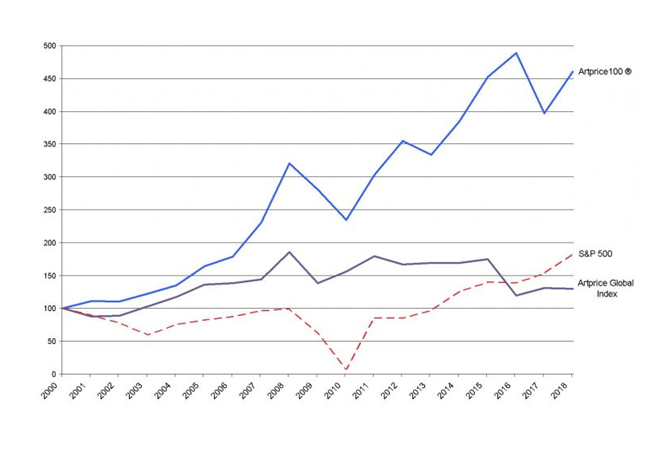

That's easier said than done, but in principle (and according to the Artprice 100 index above) there is some potential for growth here, but first my two golden rules;

Beauty is in the eye of the Beholder

Firstly, always remember the above adage because it really matters with art. Since it’s very tricky to determine the true value of an artwork as a lot depends on the artist’s reputation and on the economy as a whole, you should be comfortable assuming speculative risk and that you need to be in for the long haul.

Secondly, get to know something about art. If I’ve said it once I’ve said it a hundred times, people who put money into something that they don’t understand are gamblers – not investors. You don’t need to be an expert but have a read up on the subject.

Warhol, Picasso or Kusama?

OK, so you’re probably not going to be going for any of those names, but if you are going to invest in art then at some point you need to invest in an artist, which can itself be a bit daunting.

You're unlikely to discover the next big ‘thing’ before the artist has earned a reputation and started commanding high prices for their work. And, sad as it may be, works by living artists don't fetch the same prices at auction as pieces by those who are no longer with us.

You also can't just go down to your local antique store and find a real Monet, Modigliani, Matisse or Munch on sale for a few pounds. Buying work by one of these artists at auction would cost millions.

So instead, visit local galleries and see what they have to offer; chat with curators who will usually be eager to answer any of your questions. If you live in or near a city, you’re probably close to galleries and art fairs, where up-and-coming artists showcase their pieces. Artists often have their own websites from which they sell direct, so be active in your research.

Browse sites like

Artnet and online auction houses like

Sotheby’s and

Christies to get a sense of how the market works.

Even if you manage to acquire a piece that increases in value, bear in mind that the art market is relatively illiquid.

That means you'd typically have to wait to sell, and you'll incur fees to a broker or auction house to liquidate your holdings if you want to cash in on your investment. Nothing in the art world is about making a quick buck.

Also, remember that art is typically a tangible asset. Unlike intangible assets such as a regular investment portfolio, art usually takes up physical space. Care and maintenance are required to ensure that the art retains its value. If you're displaying the art in your home, then you'll need to be mindful of the temperature, humidity, sunlight, and various other factors that could degrade the work – not to mention that it needs to be insured and secure from theft.

Various other costs to consider with the purchase and sale of artwork include; tax (in the UK), transportation expenses, authentication and appraisal fees and insurance. You may also want to buy a nice frame, a stand or another type of display device for your artwork.

Is there a lower-cost alternative?

While most people can’t afford art that costs millions of pounds, investment platforms like

Masterworks allow people to make investments in small increments to own a share of a masterpiece by Picasso, Warhol, or other prestigious artists.

The company uses ArtTech to analyse auction data to anticipate which artists and artworks will appreciate in value over time. It targets work by artists whose pieces have typically yielded annual returns of 9 percent to 15 percent.

While you won’t have something to hang on your wall, if you’re operating on a tight budget and just want some diversification then it might be the way to go.

Conclusion

Investing in art isn't for everyone and it shouldn’t make up a major part of your portfolio. It carries a lot of risk and investors shouldn't expect huge returns, even from a diversified collection of works.

But if you buy artwork that makes you happy, at the very least you'll own pieces that you love and can proudly display. Plus, if any of your artwork substantially increases in value, then you can sell those pieces for a handsome profit and use the proceeds to reinvest or perhaps even invest in some fine wines

(see my blog article here).