After years of saving towards your retirement, the time has finally arrived where you begin to take out your hard earned (well invested no doubt) money from your pension/SIPP. But how much can you safely withdraw each year without needing to worry about running out of money?

It’s a very tricky answer because theoretically retirement can last 30 odd years or more these days, so you need a strategy that’s built for the long haul. Now, many of us Financial Planners use cash flow modelling software to help us plan for such occasions (see my blog http://www.moneymaxonline.com/modern-retirement-planning/) but, what if you’ve not got access to this sophisticated tool or you want to just manage this process yourself?

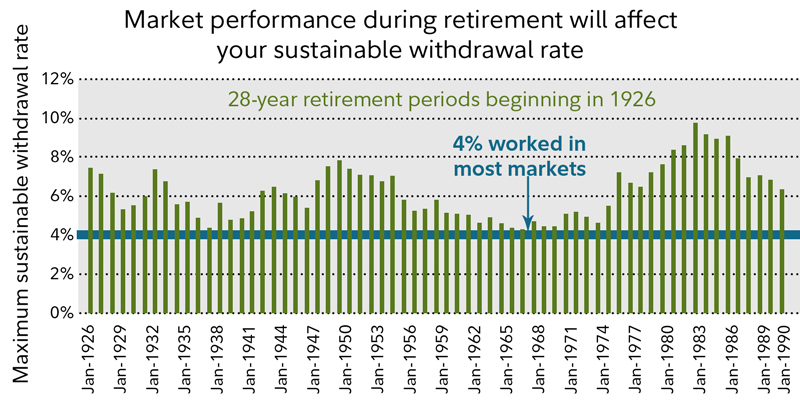

Well, if we look back across the last thirty or so years and simulate many potential outcomes (we call this the Monte Carlo theory) then its estimated that you should aim to withdraw no more than 4% to 5% of your savings/pension in the first year of your retirement (this should work 90% of the time apparently). This is commonly known as the ‘Safe Withdrawal Rate’ rule.

The reason, by the way, that I’ve highlighted the first year being the important one is that in each subsequent year you adjust this figure by inflation. This is a very important concept often missed by planners, who mistakenly think that its 4% every year infinitum. It isn’t. Withdrawing on this basis is likely to see a decreasing income but an increasing pot.

I have to admit here, I’m not a fan of this rule of thumb business (no surprise there) as I believe that there are loads of problems with the safe withdrawal rate rule. Firstly, in most cases people want to withdraw more money in the early years of their retirement whilst they’ve still got their health rather than the middle and latter periods – so it doesn’t make a whole lot of sense being so stringent if you can’t actually enjoy your retirement (and vice versa, what’s the point of a big income if you don’t need it later)!

Secondly, it’s based upon historical evidence based on an average of returns over the last 30 to 40 odd years of a combination of investments and savings – but of course, that was then, and this is now.

Consider the chart below, which illustrates a historical look at how much an investor could have withdrawn from savings without running out of money over a 28-year retirement, depending on the date of retirement. As you can see, actual sustainable withdrawal rates varied widely; from just under 10% if you retired in 1982at the beginning of a roaring bull market, compared to slightly more than 4% if you retired in 1937, during the Great Depression.

One of the major things to remember is that the earlier you retire the longer you need to fund your retirement for. So, say you expect to retire at age 70, or if you have health issues that compromise your life expectancy, you may want to plan on a shorter retirement period, say 25 years. The historical analysis shows that over a 25-year retirement period, a 4.9% withdrawal rate has worked 90% of the time.

On the other hand, if you are retiring at age 60, or have a family history of longevity, you may want to plan for a 35-year retirement. In that case 4.3% was the most you could withdraw for a plan that worked in 90% of the historical periods. These may sound like small differences, but they could equate to thousands of pounds in annual retirement income.

Ultimately, I’m a big believer in more sophisticated planning (again see my blog on the subject) but the ‘Safe Withdrawal Rate’ approach can help when perhaps you don’t have sophisticated planning in place.